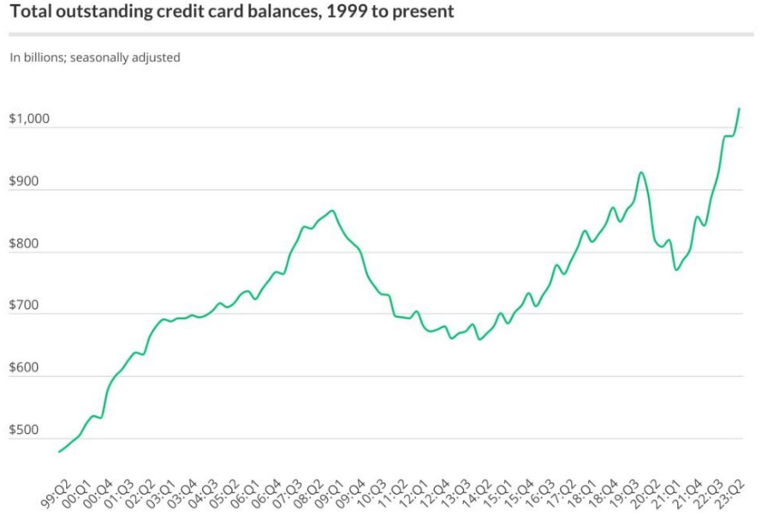

In all fairness, graphing that only makes sense in inflation-adjusted dollars, which judging by the legend isn’t the case (the seasonal adjustment only smooths the differences between quarters).

Mind you, I still expect it will keep it’s shape in the last few years, but it might show the current point as below the 2009 peak (not that it makes it any better).

Sorry, I used to work in Finance and am a bit of stickler for clearity in Financial and Economic figures :/

I’m not an economist but anecdotal evidence that I’ve picked up from a number of different sources in the last couple of years lends me to believe that consumer debt is pretty darn high. This is from the Federal Reserve and what else is an average schmuck supposed to look at?

Oh yeah, the explosion of indebtness at all levels has been the tendency for decades now, certainly ever since money creation started being done by the banks themselves when they lent money (there’s an interesting paper from the Bank Of England called “Money Creating in the Modern Economy” which is quite the eye-opener on how money is created nowadays)

All the obcession with Public Debt is to a large extent smoke and mirrors: both consumer and corporate debt have grown just as fast or even faster and are very high as percentage of GDP compared to the historic average.

In many ways we’re repeating the period that led to the Great Crash of 1929.

My point in the last post was about the graphic itself rather than critical of the point you were making.

Understood. Whether or not we are replicating economic conditions from 1929 is another story entirely. Other than AI, there really isn’t too much of a stock market bubble. The S&P 500 P/E ratio is lower than pre-pandemic and the Buffett indicator(US stock market value divided by GDP) is still well within a safe range. 1929 was pre-globalization, pre-SEC and there were next to no banking regulations at the time. The Internet bubble of 2000 with its insane speculation more closely resembled the crash of 29 than does the current market conditions. The 2008 housing debacle was primarily too much leveraged mortgage debt.

I’m not a student of economics and haven’t studied much of it but I have owned stocks for quite a few years and have a basic understanding of how money works.

Oh, a lot of banking regulation introduced after 29 was rolled back in the 90s and 00s and not restored after the 2009 Crash.

I was actually in Investment Banking before, during and after the 2008 Crash and unconditional rescues with no lessons learned were all the rage.

That said, my point comes more from the economic super-cycle which takes about an century and is mostly visible in terms of general indebtness. This stuff has to do with the nature of economic activity in general and risk aversion (or lack thereof) by economic actors, so it’s way beyond mere stockmarkets and their crashes (which reflect it rather than drive it).

There’s a lot going on with anemic growth and the “solution” for the persistent recession after the 2008 Crash - ultra-low interest rates - being rolled back due to an accumulation of bubbles all over the Economy leading to Inflation (which was already going up before the war in Ukraine), in turn causing rumbles in the realestate mortgage market and the more bubbly stockmarkets like the Nasdaq (and even more in the Tech Startup investment asset class).

I mean, we’re even seeing the rise of populism in politics.

I suspect we might be living in interesting times.

You can look up delayed gratification all you want but the majority of American consumers will never actually understand it.

In all fairness, graphing that only makes sense in inflation-adjusted dollars, which judging by the legend isn’t the case (the seasonal adjustment only smooths the differences between quarters).

Mind you, I still expect it will keep it’s shape in the last few years, but it might show the current point as below the 2009 peak (not that it makes it any better).

Sorry, I used to work in Finance and am a bit of stickler for clearity in Financial and Economic figures :/

I’m not an economist but anecdotal evidence that I’ve picked up from a number of different sources in the last couple of years lends me to believe that consumer debt is pretty darn high. This is from the Federal Reserve and what else is an average schmuck supposed to look at?

Oh yeah, the explosion of indebtness at all levels has been the tendency for decades now, certainly ever since money creation started being done by the banks themselves when they lent money (there’s an interesting paper from the Bank Of England called “Money Creating in the Modern Economy” which is quite the eye-opener on how money is created nowadays)

All the obcession with Public Debt is to a large extent smoke and mirrors: both consumer and corporate debt have grown just as fast or even faster and are very high as percentage of GDP compared to the historic average.

In many ways we’re repeating the period that led to the Great Crash of 1929.

My point in the last post was about the graphic itself rather than critical of the point you were making.

Understood. Whether or not we are replicating economic conditions from 1929 is another story entirely. Other than AI, there really isn’t too much of a stock market bubble. The S&P 500 P/E ratio is lower than pre-pandemic and the Buffett indicator(US stock market value divided by GDP) is still well within a safe range. 1929 was pre-globalization, pre-SEC and there were next to no banking regulations at the time. The Internet bubble of 2000 with its insane speculation more closely resembled the crash of 29 than does the current market conditions. The 2008 housing debacle was primarily too much leveraged mortgage debt.

I’m not a student of economics and haven’t studied much of it but I have owned stocks for quite a few years and have a basic understanding of how money works.

Oh, a lot of banking regulation introduced after 29 was rolled back in the 90s and 00s and not restored after the 2009 Crash.

I was actually in Investment Banking before, during and after the 2008 Crash and unconditional rescues with no lessons learned were all the rage.

That said, my point comes more from the economic super-cycle which takes about an century and is mostly visible in terms of general indebtness. This stuff has to do with the nature of economic activity in general and risk aversion (or lack thereof) by economic actors, so it’s way beyond mere stockmarkets and their crashes (which reflect it rather than drive it).

There’s a lot going on with anemic growth and the “solution” for the persistent recession after the 2008 Crash - ultra-low interest rates - being rolled back due to an accumulation of bubbles all over the Economy leading to Inflation (which was already going up before the war in Ukraine), in turn causing rumbles in the realestate mortgage market and the more bubbly stockmarkets like the Nasdaq (and even more in the Tech Startup investment asset class).

I mean, we’re even seeing the rise of populism in politics.

I suspect we might be living in interesting times.